WebGrowHub 360° Digital Transformation for Financial Services: Unlocking Efficiency, Security, and Success for Accounts Angel

Table of Contents

Client Overview:

Client Name: Accounts Angel

Industry: Financial Services (Accounting and Bookkeeping)

Project Scope: Digital transformation for financial services includes the transformation of bookkeeping, client onboarding, data management, and payment systems, with the implementation of secure cloud infrastructure and online meeting booking systems..

Background: Accounts Angel is a financial services provider specializing in accounting, bookkeeping, and financial consultancy. The company faced challenges with manual data management, client onboarding, and inefficient communication and scheduling systems. They required a complete digital solution to optimize their operations, improve client experience, and ensure data security. WebGrowHub was tasked with automating their booking systems, streamlining data management, and providing a secure online platform for their clients.

Industry: Financial Services (Accounting and Bookkeeping)

Project Scope: Digital transformation for financial services includes the transformation of bookkeeping, client onboarding, data management, and payment systems, with the implementation of secure cloud infrastructure and online meeting booking systems..

Background: Accounts Angel is a financial services provider specializing in accounting, bookkeeping, and financial consultancy. The company faced challenges with manual data management, client onboarding, and inefficient communication and scheduling systems. They required a complete digital solution to optimize their operations, improve client experience, and ensure data security. WebGrowHub was tasked with automating their booking systems, streamlining data management, and providing a secure online platform for their clients.

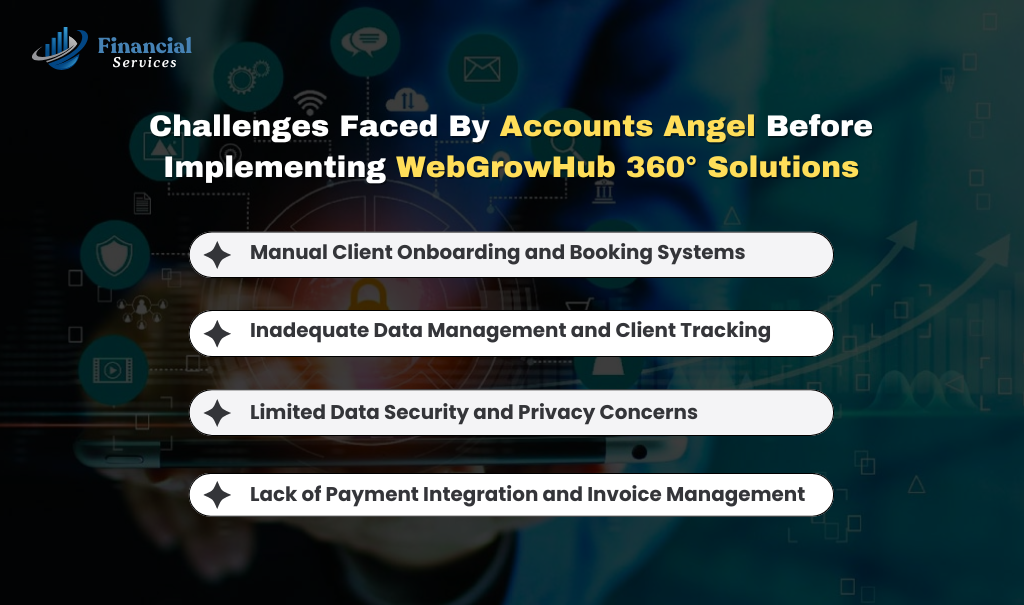

Challenges Faced: The Need for Digital Transformation for Financial Services

Accounts Angel encountered several operational and technical challenges that impacted their business efficiency, highlighting the need for digital transformation for financial services to streamline operations and enhance performance.

1. Manual Client Onboarding and Booking Systems:

- Accounts Angel relied on manual methods for managing client appointments and bookings, leading to scheduling errors and delays.

- The lack of a centralized calendar system resulted in inefficiencies and miscommunication with clients.

2. Inadequate Data Management and Client Tracking:

- Client data, including financial information and transaction history, was managed through manual spreadsheets, leading to increased risk of errors, security concerns, and data loss.

- The company struggled with tracking client leads, making it difficult to ensure timely follow-ups.

3. Limited Data Security and Privacy Concerns:

- With client financial data being stored manually, there were concerns about data security and compliance with privacy regulations. The company lacked a system to ensure SSL encryption, data backup, and secure storage of sensitive information.

4. Lack of Payment Integration and Invoice Management:

- Accounts Angel lacked a digital invoicing and payment system, resulting in delayed payments and manual invoicing errors, impacting cash flow and operational efficiency.

WebGrowHub Solution: Driving Digital Transformation for Financial Services with Innovation

WebGrowHub delivered a comprehensive digital transformation for financial services at Accounts Angel, integrating cloud systems, secure payment gateways, and automated scheduling to streamline operations and improve client service.

1. Cloud-Based Accounting System and Data Management

A. Cloud Integration for Data Security:

- WebGrowHub implemented a cloud-based accounting system for Accounts Angel, allowing real-time data access while ensuring data security.

- SSL encryption was integrated to protect client financial data, and automated data backups were set up to prevent data loss.

B. Secure Client Data Management:

- All client financial data, including transaction records and invoices, was digitized and stored on secure cloud systems, ensuring compliance with data privacy regulations like GDPR.

- Role-based access control was implemented to ensure that only authorized personnel could access sensitive data.

2. Online Booking System and Meeting Scheduler

A. Automated Appointment Scheduling:

- WebGrowHub developed an online booking system that allowed clients to book consultations directly via the website. The system integrated with a calendar and enabled real-time scheduling, reducing the risk of booking conflicts.

- Clients could view available time slots and book meetings at their convenience, improving client satisfaction and time efficiency.

B. Integrated Payment Gateway:

- An integrated payment system was developed, allowing clients to pay for services online through secure payment gateways. This streamlined the invoicing and payment process, improving cash flow and reducing manual billing errors.

3. CRM Integration for Lead and Client Management

A. Lead Management System:

- WebGrowHub integrated a CRM system that allowed Accounts Angel to track client leads and follow up with them through automated email reminders and task management features.

- The CRM system provided insights into the client lifecycle, helping Accounts Angel improve conversion rates and ensure no leads were lost.

4. Digital Marketing and SEO for Brand Visibility

A. SEO Optimization and Content Strategy:

- WebGrowHub optimized Accounts Angel’s website for SEO to increase visibility on search engines. We created content focused on relevant keywords in the financial services sector to drive organic traffic.

- Content marketing strategies, including blogs and articles about tax planning, bookkeeping tips, and financial consultancy, helped increase their online presence.

B. Social Media Engagement:

- Although social media wasn't the core focus, WebGrowHub worked on basic social media presence to increase brand visibility and engage with potential clients on LinkedIn and Facebook, focusing on building trust and offering free resources on financial literacy.

Results Achieved: Success through Digital Transformation for Financial Services

WebGrowHub’s digital transformation for financial services provided tangible improvements for Accounts Angel, enhancing efficiency, security, and client satisfaction.

1. 50% Reduction in Appointment Scheduling Conflicts:

- The online booking system and calendar integration led to a 50% reduction in scheduling conflicts, improving both client satisfaction and staff efficiency.

2. 40% Improvement in Lead Conversion Rates:

- The CRM system and automated follow-ups resulted in a 40% improvement in lead conversions, as clients received timely communication and were better managed throughout the sales funnel.

3. 25% Increase in Revenue:

- The integrated payment gateway and digital invoicing system streamlined the payment process, leading to a 25% increase in revenue due to faster payment collections and improved billing accuracy.

4. Enhanced Data Security and Compliance:

- The new cloud-based system with SSL encryption and automated backups provided Accounts Angel with improved data security, reducing the risk of data breaches and ensuring compliance with privacy regulations.

5. 35% Increase in Client Engagement:

- Through SEO optimization and content marketing, Accounts Angel saw a 35% increase in client engagement, which helped build brand authority and trust in the financial services sector.

Client Testimonial

"WebGrowHub’s solutions have completely transformed our operations. The cloud-based accounting system, online booking system, and secure payment integrations have streamlined our processes, improved our client experience, and boosted our revenue. The CRM system has also helped us track leads and follow up more effectively, resulting in increased conversions. WebGrowHub’s digital transformation for financial services has truly been a game-changer for our business."

— Accounts Angel Representative

Future Collaboration:

WebGrowHub continues to support Accounts Angel with ongoing digital transformation for financial services, including advanced data analytics, AI-powered insights, and scalable solutions to enhance client engagement and operational efficiency.

- Advanced Data Analytics for improving financial forecasting and client reporting.

- AI-powered insights to optimize client engagement and marketing strategies.

Call to Action

"Ready to streamline your financial services business and improve client satisfaction? Let WebGrowHub help you automate your operations and grow your revenue. Contact us today to get started!"

Schedule Your Demo Now

Schedule Your Demo Now

Contact Us

Ready to enhance your business with advanced tools and features? Contact WebGrowHub today to create a professional, high-converting website and connect with buyers globally.

- Mumbai Office: Marine Drive, Nariman Point Mumbai, Maharashtra 400 021

- Pune Office: Kakade Plaza, Office No. 50, Karve Nagar, Pune, Maharashtra 411052

- Global Reach: Proudly serving resorts from Dubai to Maldives, Bali to New York, and beyond.

Follow Us

Stay connected for the latest in real estate technology, property listing tools, and online real estate solutions:

© WebGrowHub. All rights reserved 2024.